The Hidden Travel Costs to Plan For or Avoid

Creating a travel budget is an important part of planning your trip. And you need to beware of the sneaky hidden costs that can threaten to bust your travel budget. From airline seat selection fees to rental car surcharges, these unexpected costs can add up quickly. This article will help you arm yourself with the knowledge to outsmart the hidden costs so you can avoid them or plan for them ahead of time.

This post includes affiliate links. If you make a purchase through one of these links, I may earn a small commission at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases. See disclaimer.

Baggage fees

Checked baggage fees and other luggage-related surcharges can really sneak up on you while you’re booking your flights. And they can significantly impact your travel budget. Some airlines may offer low upfront ticket costs but compensate by charging for all the “extras.”

Extra airline costs to consider:

- Some airlines allow a free personal item but charge for a carry-on. This can come as a surprise for those who book basic economy (depending on the airline).

- Checked bag fees vary widely and have recently gone up with certain airlines. Prepaying for checked bags can sometimes save you money.

- Checking multiple bags

- Exceeding weight or size limits

Look into airline frequent flyer programs and co-branded credit cards for benefits you might be able to take advantage of. For example, we get free checked bags and priority boarding with our Chase United Mileage Plus Explorer card.

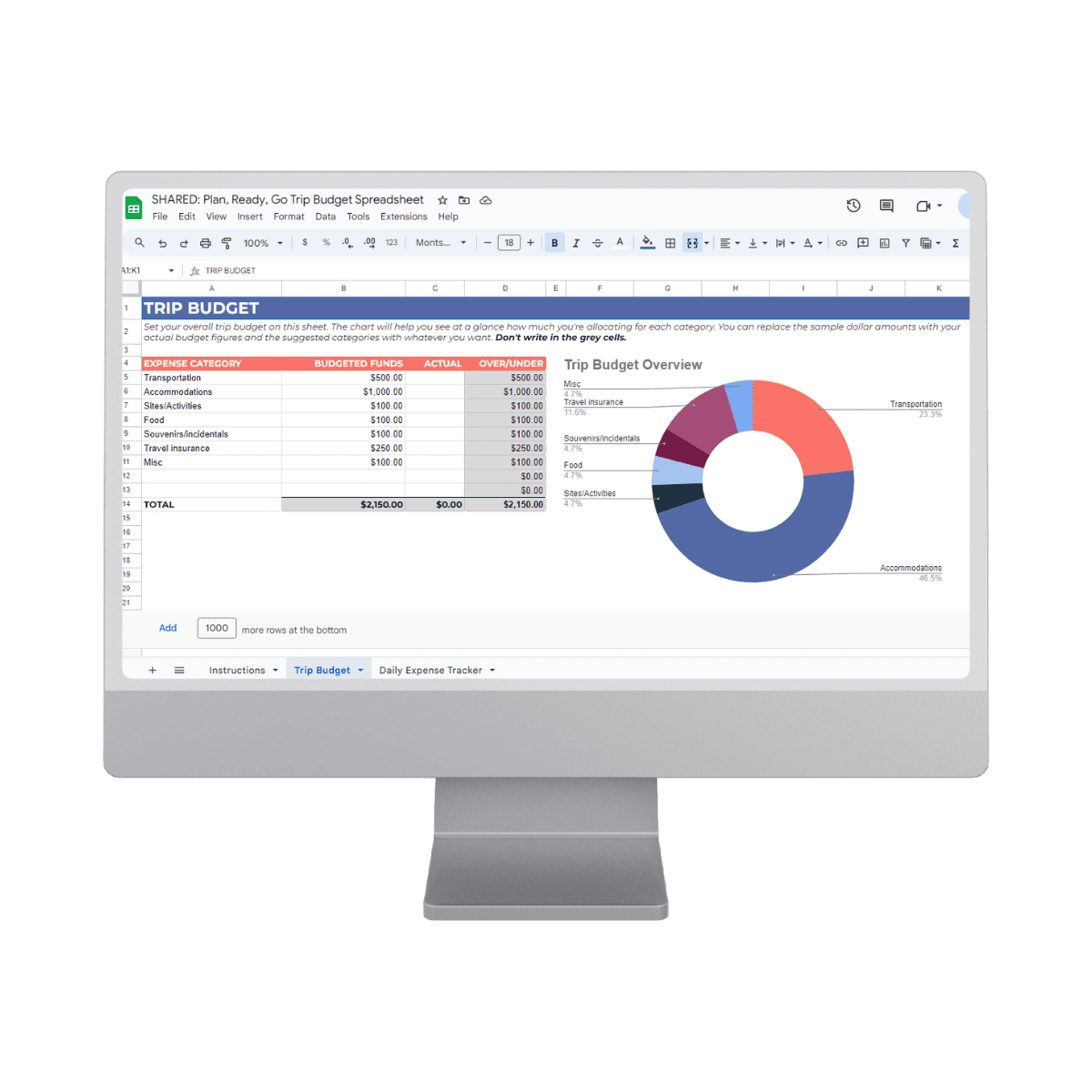

Track your travel budget easily

The best way to keep a rein on your travel expenses is to track everything you spend. The Plan, Ready, Go Trip Budget Spreadsheet will give you the tools to plan your budget before you travel and also track your expenses each day as you travel.

Prefer to track your trip budget and expenses with paper and a pencil? Check out the Plan, Ready, Go Printable Trip Budget Trackers.

Seat selection fees

Advanced seat selection fees are common. Whether it’s extra legroom you’re after or making sure you’re seated with your travel companions, selecting a seat in advance can sometimes come at a premium.

Airlines typically offer a range of seating options, with prices that vary based on the seat’s location and comfort level. For instance, standard seats may be free or have a nominal fee. Preferred seating, like exit row seats or those closer to the front of the plane, might cost more.

PRO TIP: If you have flexible travel dates you need to check out Going (formerly Scott’s Cheap Flights). You get amazing flight deals sent straight to your inbox with instructions on how to book directly with the airlines. Check out Going here. Going is my favorite way to find great travel deals.

Foreign transaction fees

When you travel outside your home country, foreign transaction fees can be an unexpected expense on your bank statements. These are fees your credit card issuer or bank charges you for making purchases in a different currency. Often, this fee varies from 2% to 3% of each transaction made abroad.

It’s important to understand that these fees apply not only to in-person purchases but also to online transactions made with foreign merchants. This can include prepaying for attraction tickets and accommodations. For example, I paid in advance for our vacation rental in Florence, Italy, with a credit card that I routinely use for online charges completely forgetting that would be charged for that foreign transaction.

You can easily avoid these costs by using cards specifically offering zero foreign transaction fees as a benefit. Make sure you know what your credit card’s fees are like before choosing which cards you will travel with. Travel-focused credit cards often waive these fees. The trade-off though is that these cards often come with annual fees.

Currency exchange and other similar costs

When traveling abroad, currency exchange rates and associated fees can quickly add up. Beware of airport kiosks. Despite their convenience, they often carry higher costs.

Another area to watch for extra charges is ATM withdrawals in foreign countries. These machines frequently charge a fee per transaction, which varies by ATM and can become significant over multiple withdrawals. Think ahead about how much cash you will need so you can minimize the number of transactions you make during your trip.

Watch out for dynamic currency conversion options when paying with a credit card while traveling internationally. You might be offered the opportunity at the credit card terminal to pay in your currency rather than that of the country you’re visiting but you’ll get a better exchange rate if you opt out of that.

Resort fees

When you’re booking a hotel for your trip, you might stumble upon resort fees that can take a significant bite out of your budget.

Resort fees are mandatory charges that hotels charge on top of the room rate. These fees supposedly cover amenities like pool access or Wi-Fi. Often resort fees range from $25 to $40 per night, but don’t be surprised if you find some hotels charging up to $100 or more.

Remember, these fees are usually not optional, even if you don’t use the amenities you are supposedly paying for. To avoid surprises, always check the fine print when you book.

Credit card holds

When you check into a hotel, the front desk will often place a hold on your credit card. This is a security deposit to cover potential incidental charges like room service or damage. The amount can vary.

Be aware that these holds can tie up your funds while you’re traveling. Check with your hotel in advance about their hold policies to avoid surprises.

Car rental fees

When you’re planning to rent a car for your trip, there are a few extra fees that might sneak up on you. Knowing what to expect can help you budget better and avoid surprises.

Common rental car fees include:

- State and local taxes

- Facility charges

- Vehicle license fee

- Concession recovery fee

And these are in addition to the fees you can end up paying if you want to add a driver, pay for the extra insurance, or if you bring your car back excessively dirty, without a full tank of gas, or with damage.

TIP: Book your rental car through Costco Travel to get an additional driver for free.

Parking fees

Don’t forget to consider the cost of parking—it can be a significant hidden expense. In city centers and near popular tourist attractions it’s not unusual for hotels to charge $30 or more per night for parking. If you’re staying multiple nights, these costs can quickly add up, affecting your budget as much as an additional night’s stay in the hotel. To avoid this cost, make sure you check that your hotel has free parking before you book.

Public transportation, ride-sharing services, or walking to nearby attractions can help cut down on parking expenses as you explore your destination.

Travel insurance

This expense is something you need to plan for rather than try to avoid. Unexpected events can turn your trip upside down, and that’s where travel insurance comes in handy. It can cover a range of mishaps, from trip delays or cancellations to medical emergencies. And though unpleasant to think about, if you were to pass away while traveling, insurance can help with repatriating your remains back to your home country.

Most travel insurance policies offer protection for:

- Trip cancellation: Reimbursement for non-refundable trip costs if you have to cancel because of illness, weather, or other covered reasons (make sure you read your policy).

- Emergency medical coverage: Help with expenses if you get sick or injured while traveling.

- Loss, damage, or theft of luggage/personal belongings: Reimbursement for covered personal items that are lost, damaged, or stolen while you’re traveling.

- Trip interruption or delay: If your travel is delayed or you have to cut your trip short, you can recover some costs.

Though the added cost of travel insurance to your travel budget may seem like a larger up-front cost than you want to take on, the peace of mind of knowing that you, your trip, and your belongings are covered is well worth it in my opinion. Hubby and I always buy travel insurance when traveling internationally.

Miscellaneous travel expenses to be aware of

When you plan your travel budget, there are often overlooked expenses that can sneak up on you. Here are some examples:

- Hotel or airplane Wi-Fi

- Luggage lockers or storage

- Specialized clothing or gear rentals

- Visa fees

- Tourism levies or taxes

- Tips

- Tolls

- Reservation cancellation charges

- Travel apps

It’s easy to overlook the less obvious expenses that can sneak up on you. As you plan your next trip, keep an eye out for hidden costs. To save money, being informed about these potential extra charges can help you sidestep them. Some, like travel insurance, you don’t want to avoid, but you will need to plan for them when budgeting for your trip.